Halal portfolio

Build your wealth without compromising your beliefs. Our Halal portfolio is designed to comply fully with Islamic law, offering ethical investment opportunities aligned with your faith.

Invest according to your faith

Certified by Islamic scholars

Our fund is certified and reviewed semi-annually by a panel of Islamic scholars. Each audit ensures the ETF’s structure complies with Shariah principles, resulting in a Fund Fatwa — an official certification of compliance.

Shariah-compliant ETF

Every company in our fund adheres to strict ethical guidelines, with less than 5% of their income coming from industries like alcohol, tobacco, pork, weapons, traditional banking, or adult entertainment. Returns are distributed equally among all investors, ensuring fairness and equity.

Keeping your investments compliant

We conduct quarterly reviews to maintain Shariah compliance, removing non-compliant companies and adding new ones as needed. Our fund undergoes bi-annual third-party audits, and dividend purification details are published quarterly for full transparency.

Performance over time

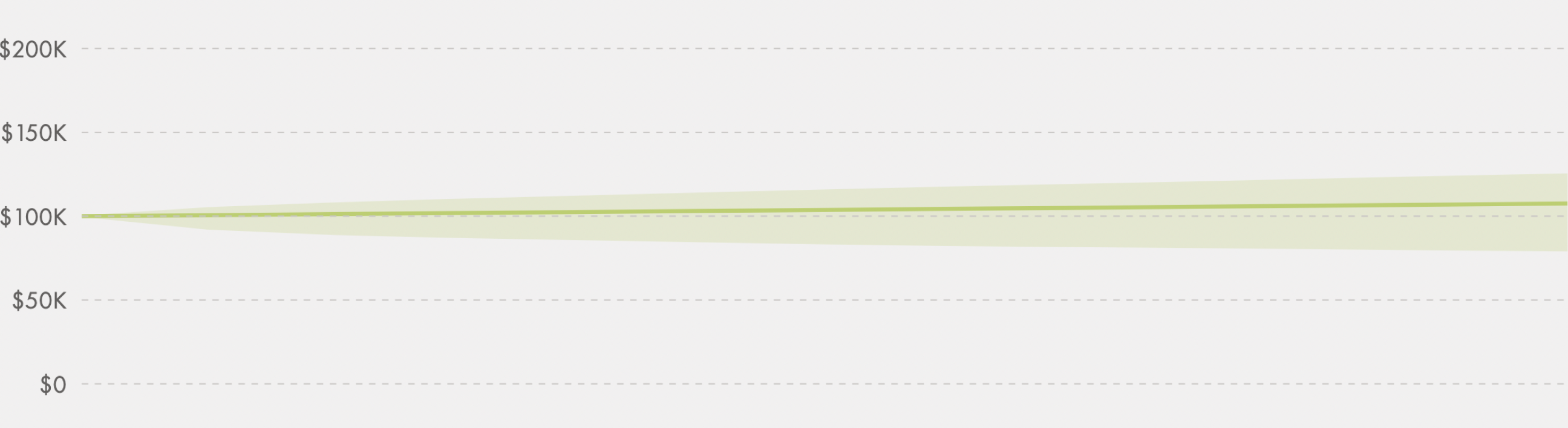

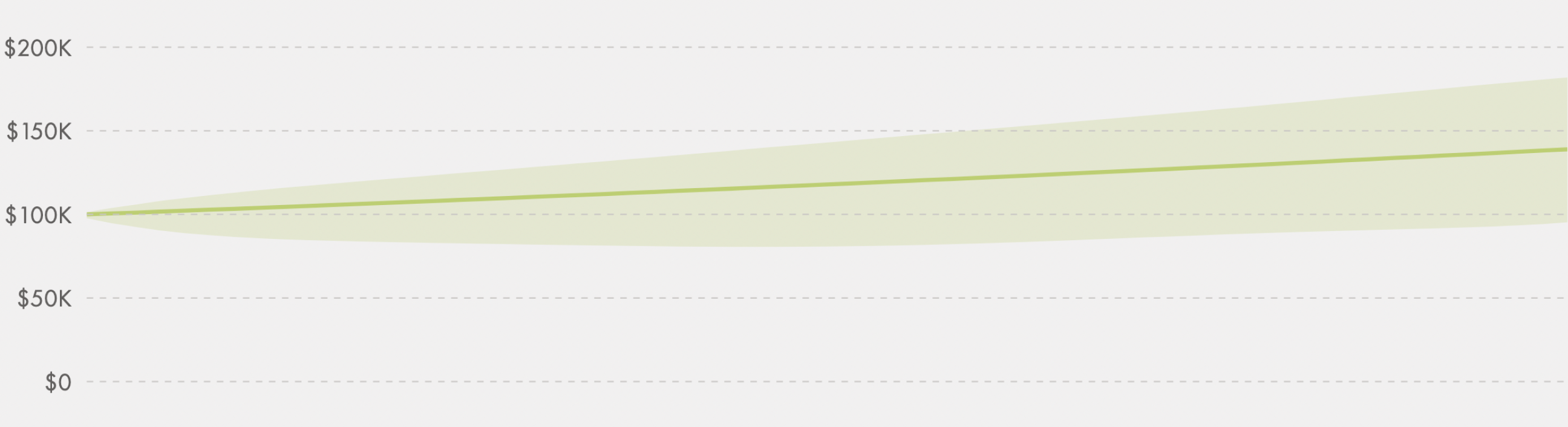

Balanced

Designed for investors who don’t plan to withdraw in the next 9+ years. If you can bear fluctuations and understand that there might be short-term periods of poor performance, this portfolio could be for you.

1Y

5Y

10Y

Total returns

6.8%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$106,799

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

Total returns

38.9%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$138,940

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

Total returns

93.0%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$193,042

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

All returns data are hypothetical and for illustrative purposes only. Returns are not indicative of expected or estimated return rates.

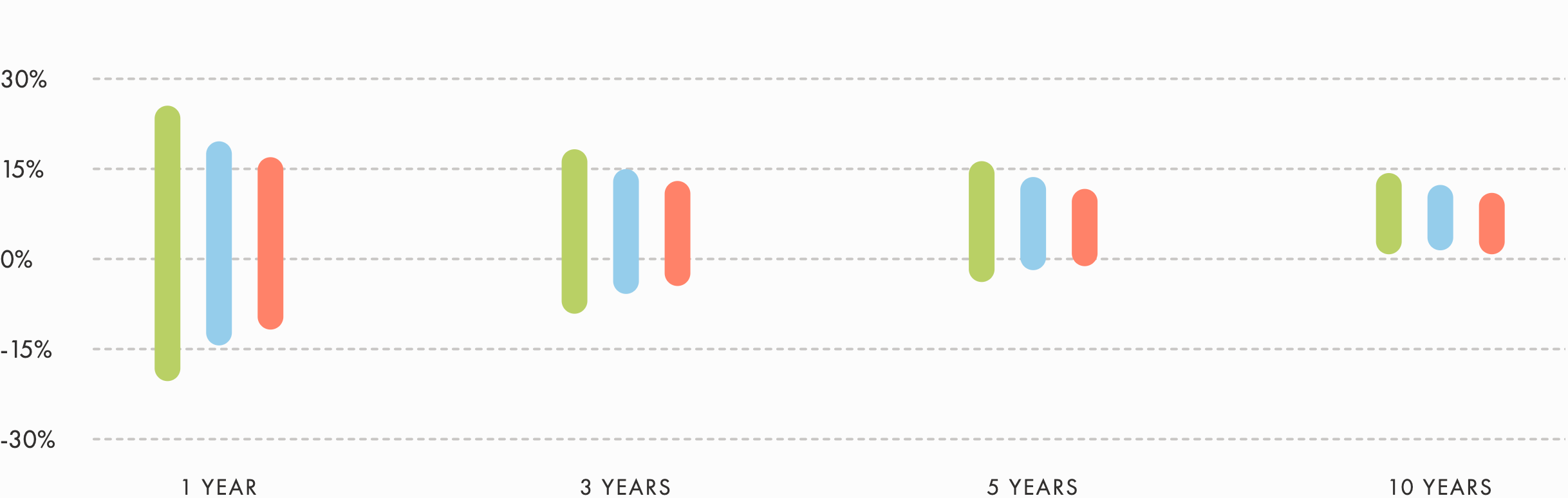

Understand the bigger picture

Riskier portfolios may experience short-term fluctuations but often deliver higher returns over the long term. Regardless of your risk tolerance, staying invested is usually the best strategy for long-term growth.

-

Growth

-

Balanced

-

Conservative

Range of annualized portfolio returns

Data is hypothetical and for illustrative purposes only. Range is not indicative of expected or estimated return rates.

Halal investing that works for you

Automatic rebalancing

Your portfolio is regularly adjusted based on deposits, withdrawals, performance, and changes in your goals, ensuring a consistent and balanced asset allocation.

Thoughtful portfolio construction

Companies in WSHR are weighted by risk, not market capitalization. Companies are screened to perform well on a low-volatility, high-quality multi-factor score.

Dividend reinvestment

Dividends are tracked and immediately reinvested into underweight ETFs, helping your portfolio stay balanced and grow efficiently.

Get the most from your investments

Navigate market ups and downs confidently with a diversified portfolio, customized to align with your personal values and financial objectives.

Get started