Classic portfolio

A carefully balanced portfolio with low-cost ETFs, spanning diverse asset types and global markets.

Key features of the Classic portfolio

Diversified for growth and stability

This portfolio offers broad geographic exposure, lower-volatility stocks (known for delivering equal or better returns than high-risk alternatives), and a mix of riskier government bonds and gold. With enhanced diversification, it’s built to navigate market downturns more effectively.

Effortless tax optimization

Forget the hassle of finding tax-efficient investments. Our system automatically selects ETFs optimized to minimize your tax burden and maximize your returns.

Tailored to your risk level

From conservative, interest-focused options to equity-heavy, high-growth portfolios, we ensure your investments align perfectly with your goals and comfort level.

Performance over time

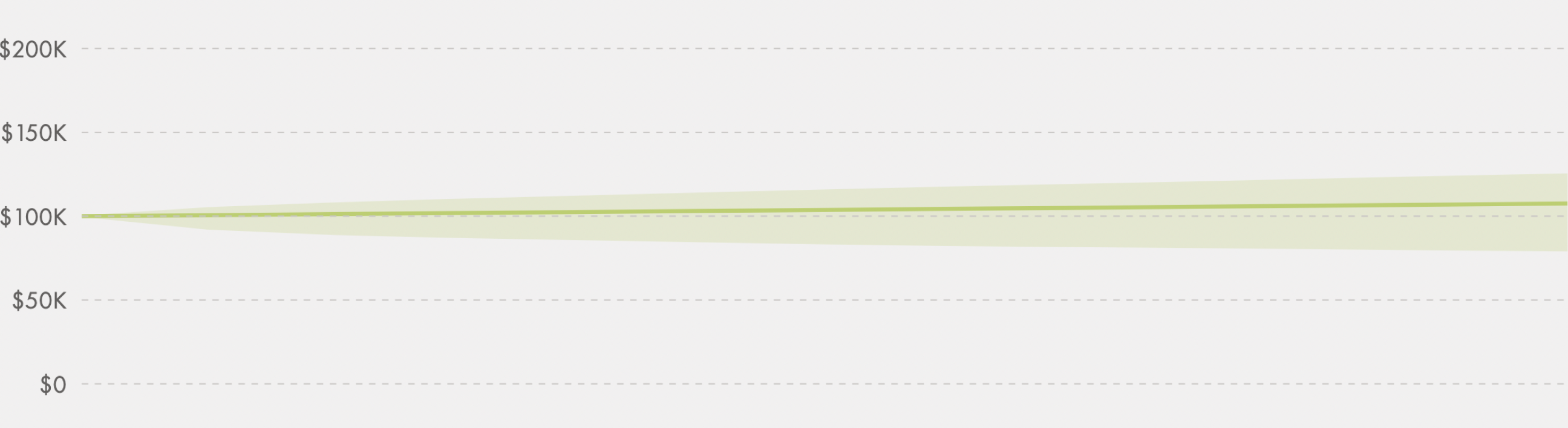

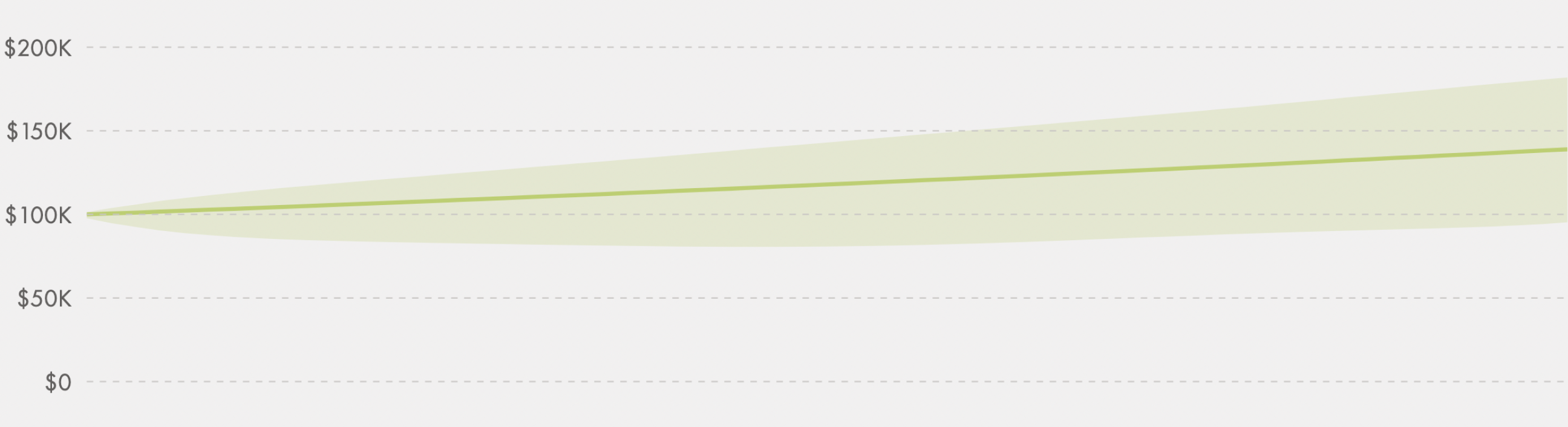

Balanced

Designed for investors who don’t plan to withdraw in the next 9+ years. If you can bear fluctuations and understand that there might be short-term periods of poor performance, this portfolio could be for you.

1Y

5Y

10Y

Total returns

6.8%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$106,799

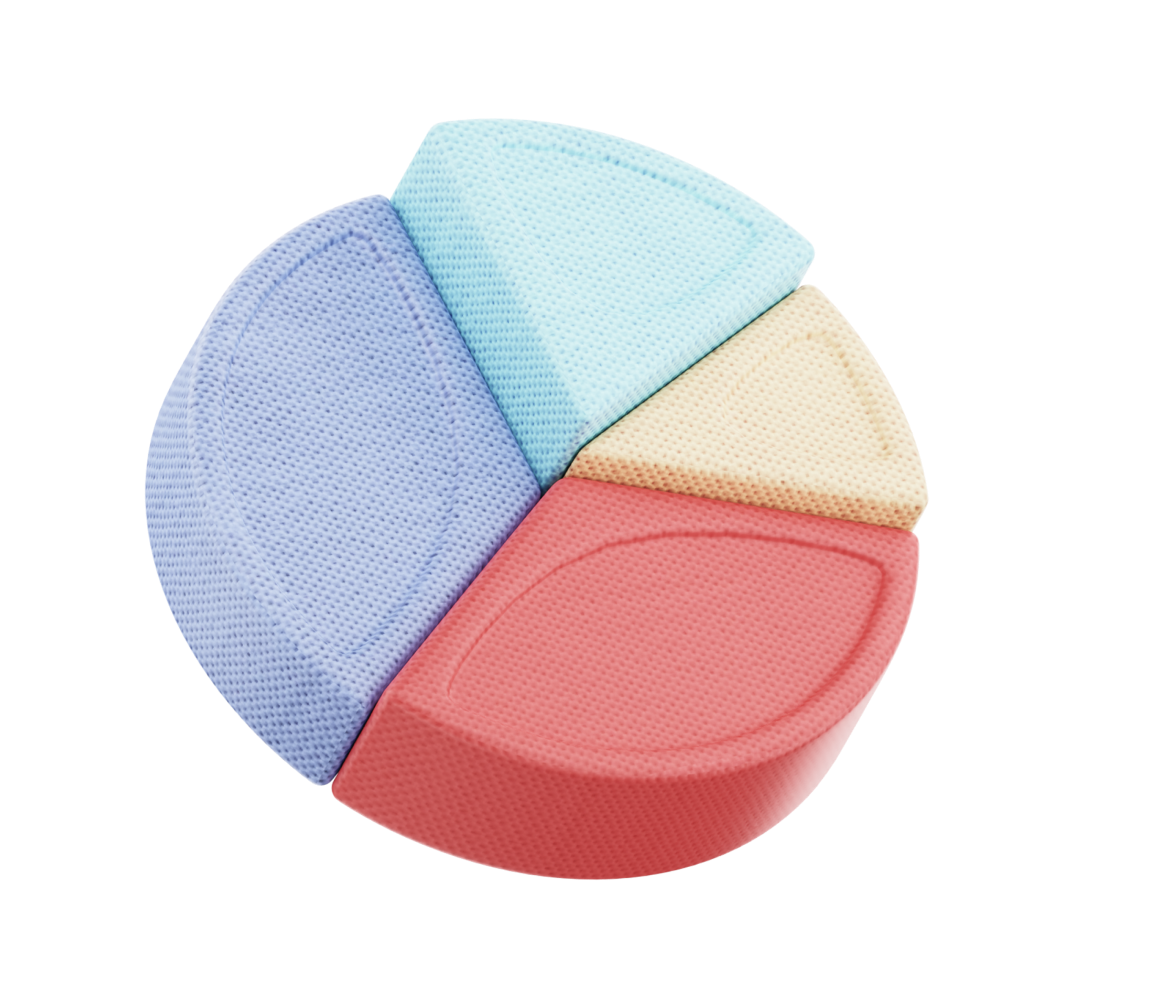

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

Total returns

38.9%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$138,940

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

Total returns

93.0%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$193,042

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

All returns data are hypothetical and for illustrative purposes only. Returns are not indicative of expected or estimated return rates.

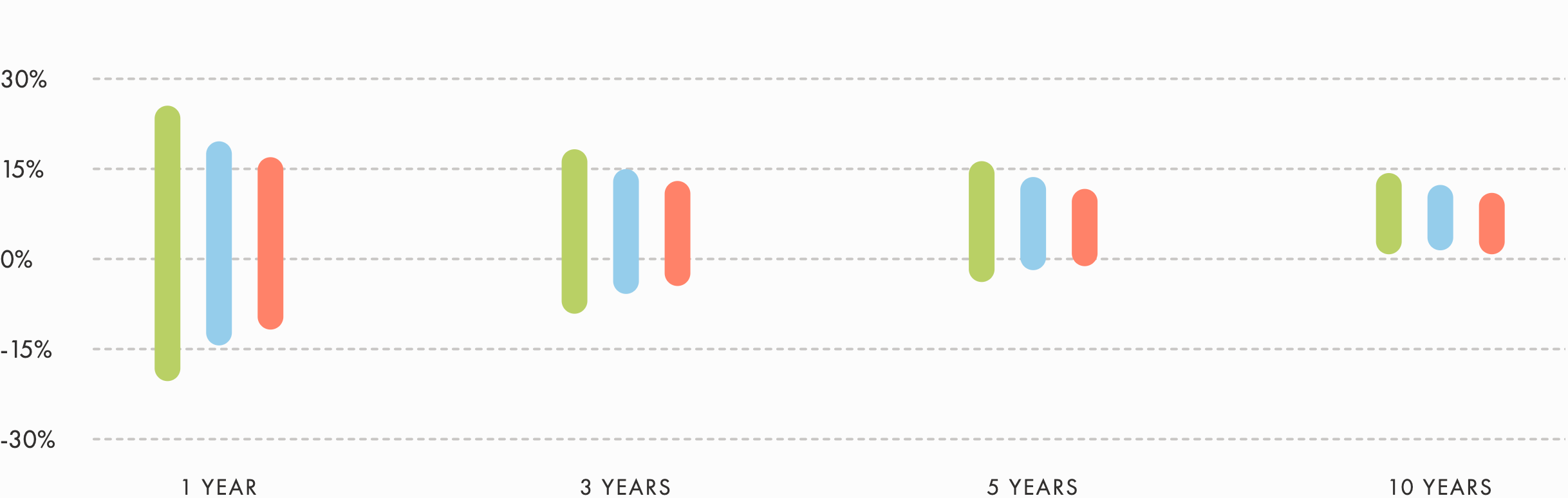

Understand the bigger picture

Riskier portfolios may experience short-term fluctuations but often deliver higher returns over the long term. Regardless of your risk tolerance, staying invested is usually the best strategy for long-term growth.

-

Growth

-

Balanced

-

Conservative

Range of annualized portfolio returns

Data is hypothetical and for illustrative purposes only. Range is not indicative of expected or estimated return rates.

Maximize your portfolio’s potential

Automatic rebalancing

Your portfolio adjusts automatically with every deposit, withdrawal, or change in your financial goals, keeping your asset allocation aligned and consistent.

Tax-optimized ETFs

We select ETFs tailored to your tax situation and account type, and negotiate with providers to secure better rates for you.

Dividend reinvestment

Dividends are tracked and reinvested immediately into underweight ETFs, ensuring your portfolio remains balanced and efficient.

Get the most from your investments

Navigate market ups and downs confidently with a diversified portfolio, customized to align with your personal values and financial objectives.

Get started