Socially Responsible portfolio

Our Socially Responsible Investing (SRI) portfolio balances strong returns with low fees, allowing you to grow your wealth while staying true to your values.

Invest in a sustainable future

Meeting the highest standards

Our portfolios are aligned with the IEA Sustainable Development Scenario and the Paris Agreement goals. Bonds in our SRI portfolio are certified by the Climate Bond Initiative, ensuring adherence to the highest environmental standards.

More than just responsible

We go beyond the usual SRI portfolios by excluding the top 25% of carbon-emitters in each industry. Additionally, every company in our funds has at least 25%, or a minimum of three, women on their board of directors.

Diversified for growth and impact

Highgate Trading's exclusive ETFs are designed to balance environmental and social responsibility with robust diversification. To further mitigate risk, the Highgate Green Bond ETF includes bonds supporting global green initiatives.

Performance over time

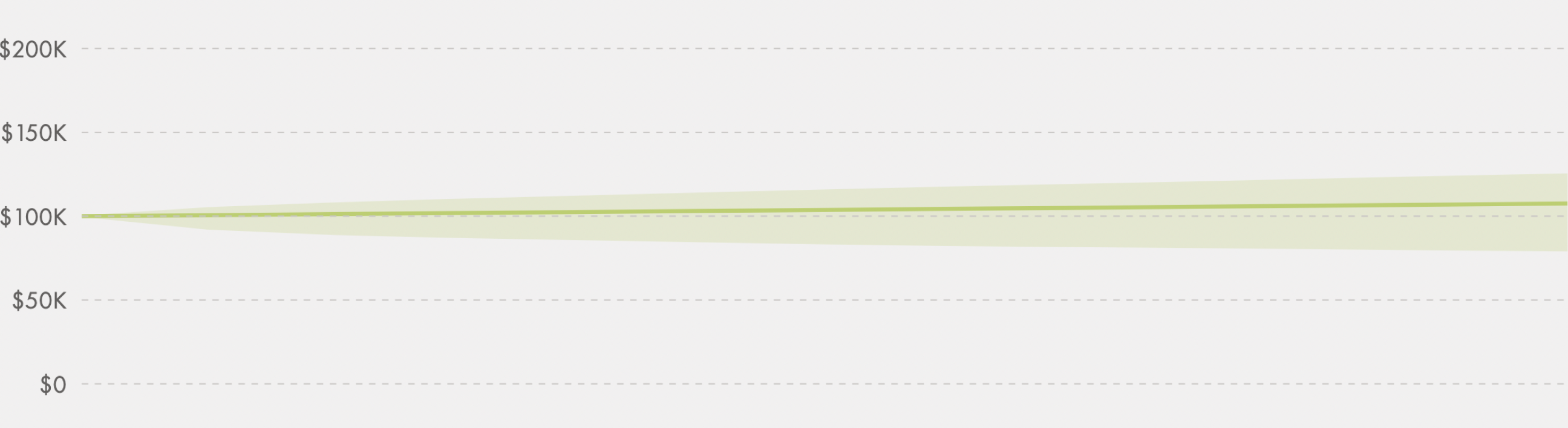

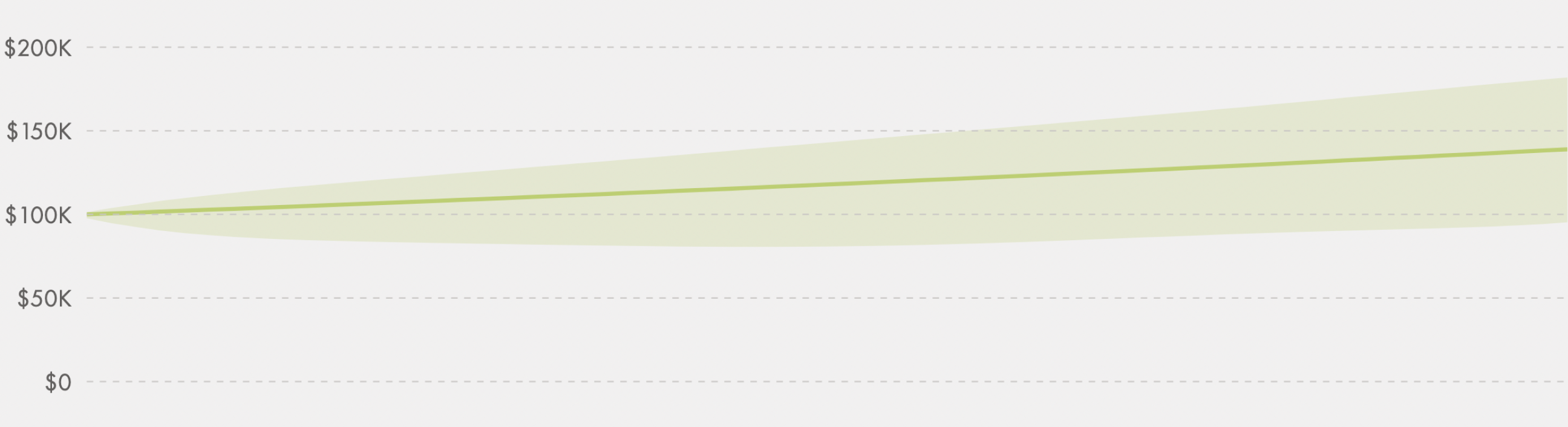

Balanced

Designed for investors who don’t plan to withdraw in the next 9+ years. If you can bear fluctuations and understand that there might be short-term periods of poor performance, this portfolio could be for you.

1Y

5Y

10Y

Total returns

6.8%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$106,799

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

Total returns

38.9%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$138,940

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

Total returns

93.0%

Annualized returns

6.8%

Starting balance

$100,000

Ending balance

$193,042

Asset classes

Allocation

Equity

60.00%

Fixed income

37.08%

Gold

2.92%

Fees

Management Expense Ratio (MER)

0.21%

Management Fee

0.50%

All returns data are hypothetical and for illustrative purposes only. Returns are not indicative of expected or estimated return rates.

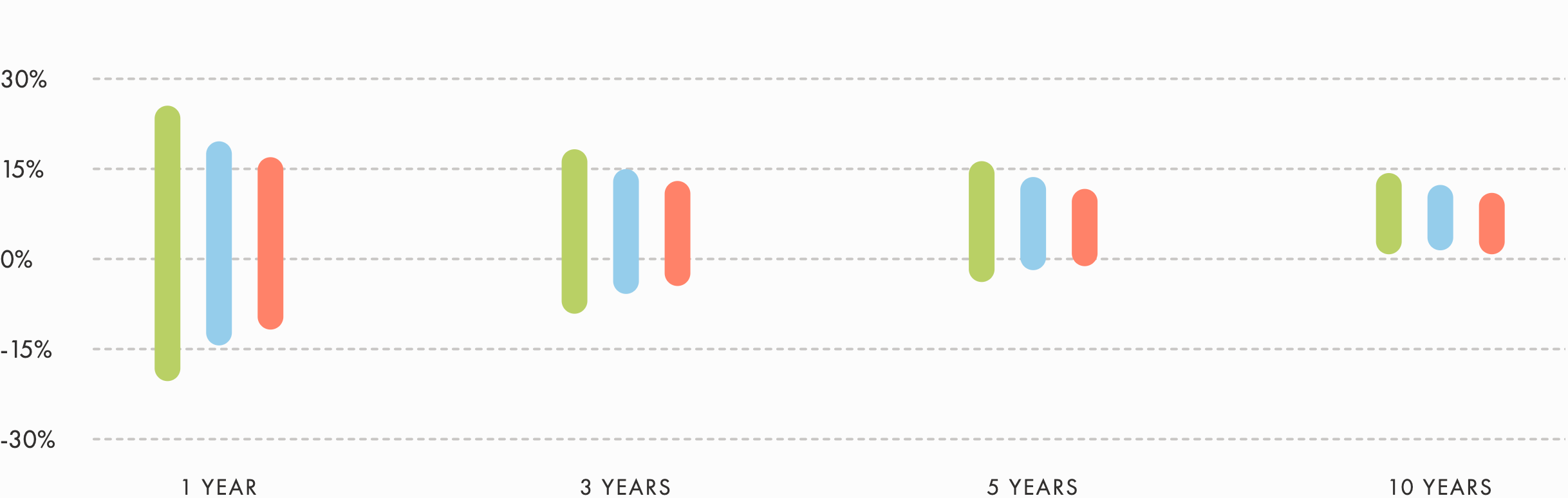

Understand the bigger picture

Riskier portfolios may experience short-term fluctuations but often deliver higher returns over the long term. Regardless of your risk tolerance, staying invested is usually the best strategy for long-term growth.

-

Growth

-

Balanced

-

Conservative

Range of annualized portfolio returns

Data is hypothetical and for illustrative purposes only. Range is not indicative of expected or estimated return rates.

Grow responsibly with an optimized portfolio

Automatic rebalancing

Your portfolio is regularly adjusted based on deposits, withdrawals, performance, and changes in your goals, ensuring a consistent and balanced asset allocation.

Advanced portfolio construction

Companies in the index are weighted by risk rather than market size. Low-performing stocks in terms of quality, value, and momentum are excluded to maintain portfolio strength.

Dividend reinvestment

Dividends are tracked and immediately reinvested into underweight ETFs, helping your portfolio stay balanced and grow efficiently.

Get the most from your investments

Navigate market ups and downs confidently with a diversified portfolio, customized to align with your personal values and financial objectives.

Get started