Registered Retirement Savings Plan (RRSP)

Choose from thousands of stocks, ETFs, and options on a platform that combines powerful tools with user-friendly simplicity.

Get started

A smarter way to plan for retirement

Save on taxes today

Contributions to your RRSP within the allowed limits are deducted from your annual income, helping you reduce your tax bill and save more.

Withdraw at a lower tax rate in the future

Your account grows tax-free until you start withdrawing, with our tax experts you can benefit from a lower tax rate at that time

Flexible withdrawal options

Use your RRSP to fund major life goals before retirement. Programs like the Home Buyer’s Plan and Lifelong Learning Plan allow limited withdrawals for purchasing a home or continuing education.

Understanding the RRSP

Who should consider an RRSP?

Individuals earning over $50,000 and comfortable saving for the long term can greatly benefit from opening an RRSP.

Couples with significant income differences might consider a Spousal RRSP to maximize tax advantages for both partners.

$71,300

The maximum contribution limit for 2024. Any unused portion can be carried forward to future years.

18%

The percentage of last year’s income you can contribute to your RRSP, provided it doesn’t exceed the annual limit set by the government.

18-71

The age of eligibility to open and invest in an RRSP. Once you turn 71, your RRSP will need to be converted to a RRIF.

Unlimited carry-over

One of the biggest advantages of an RRSP is that unused contribution room rolls over indefinitely, so you’ll never lose it.

How to invest with an RRSP

-

Personalized portfolios for your goals

With Managed investing, we handle everything for you. Share your goals and timeline for your RRSP, and we’ll create a customized portfolio diversified across the market to suit your needs.

-

Take control with self-directed investing

A Self-directed account puts you in charge of your investments. Trade over 9,000 stocks and ETFs commission-free, automate your contributions, and start trading instantly with up to $750,000 in deposits for Prime clients.

Retirement saving made easy

Start Investing in Minutes

With the help of our team experts you can open your account quickly and hassle free. With our system contributions and withdrawals are just a few taps away

Real Support, anytime

Have questions about your RRSP? Our friendly team is available 5 days a week by phone, or email to provide the help you need

Maximize your returns

Whether you prefer self-directed investing or letting us handle it for you, our low fees ensure more of your returns stay in your pocket.

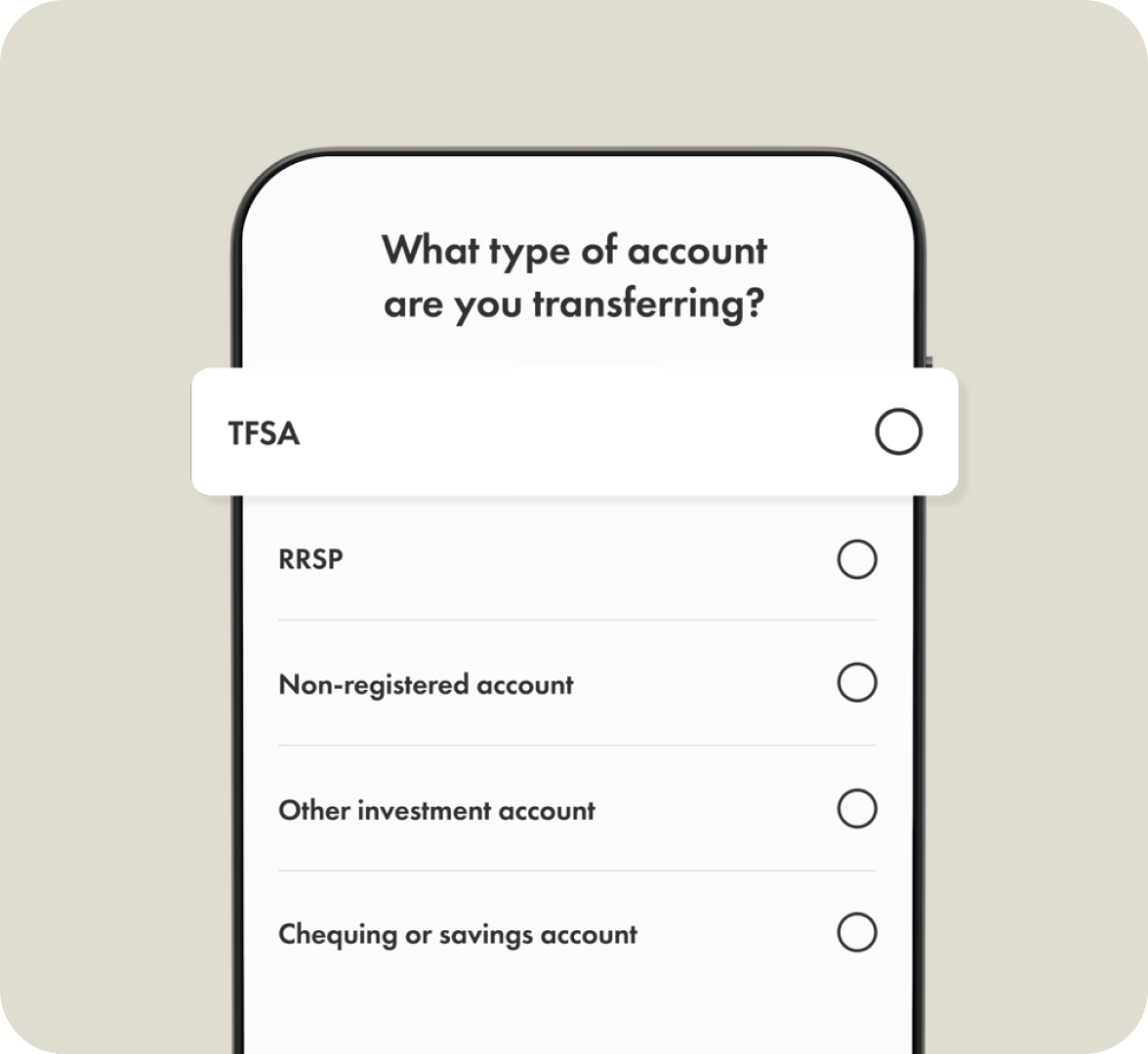

Switch your RRSP without extra costs

We’ll cover the transfer fees charged by your current brokerage when you move $15,000 or more to Highgate Trading. The process is seamless, and we make sure you start saving right away.

Contact our teamEffortless trading upgrades

Experience a better way to invest. Sign up in under three minutes and start trading with enhanced features designed to elevate your investing journey.

Get started