All Accounts

Whether you’re saving for retirement, your first home, or just a rainy day – we’ve got the right account to help your money grow.

Your money is in safe hands

Competitive rates

Invest and save with peace of mind, knowing that you’re paying lower fees and keeping more of your money in your portfolio.

Asset protection

Your securities are covered by a reputable investor protection fund up to Your securities are covered by a reputable investor protection fund up to M per defined account, and your cash is protected up to million. M per defined account, and your cash is protected up to Your securities are covered by a reputable investor protection fund up to M per defined account, and your cash is protected up to million. million.

Human help anytime you need it

Our team is available 5 days a week to assist with any questions about your account. Advance and Prime clients also have access to our dedicated in house advisors and personalized communication tailored to your time schedules

RRSP

-

Helps you save for

Retirement

-

Eligibility

18-71 years old

-

Annual contribution limit

18% of previous year's income, up to $71,300

-

Tax impact on contributions

Deducted from taxable income

-

Tax impact on withdrawals

Taxed as income (with some exceptions)

-

Government benefits

Withdrawals may impact other government benefits based on income

-

Withdrawal stipulations

Must withdraw to RRIF at 71

Maximize the potential of your account

As your wealth grows, your financial needs may evolve. Our advisors are here to ensure you're in the right account to meet your changing goals and achieve your financial aspirations.

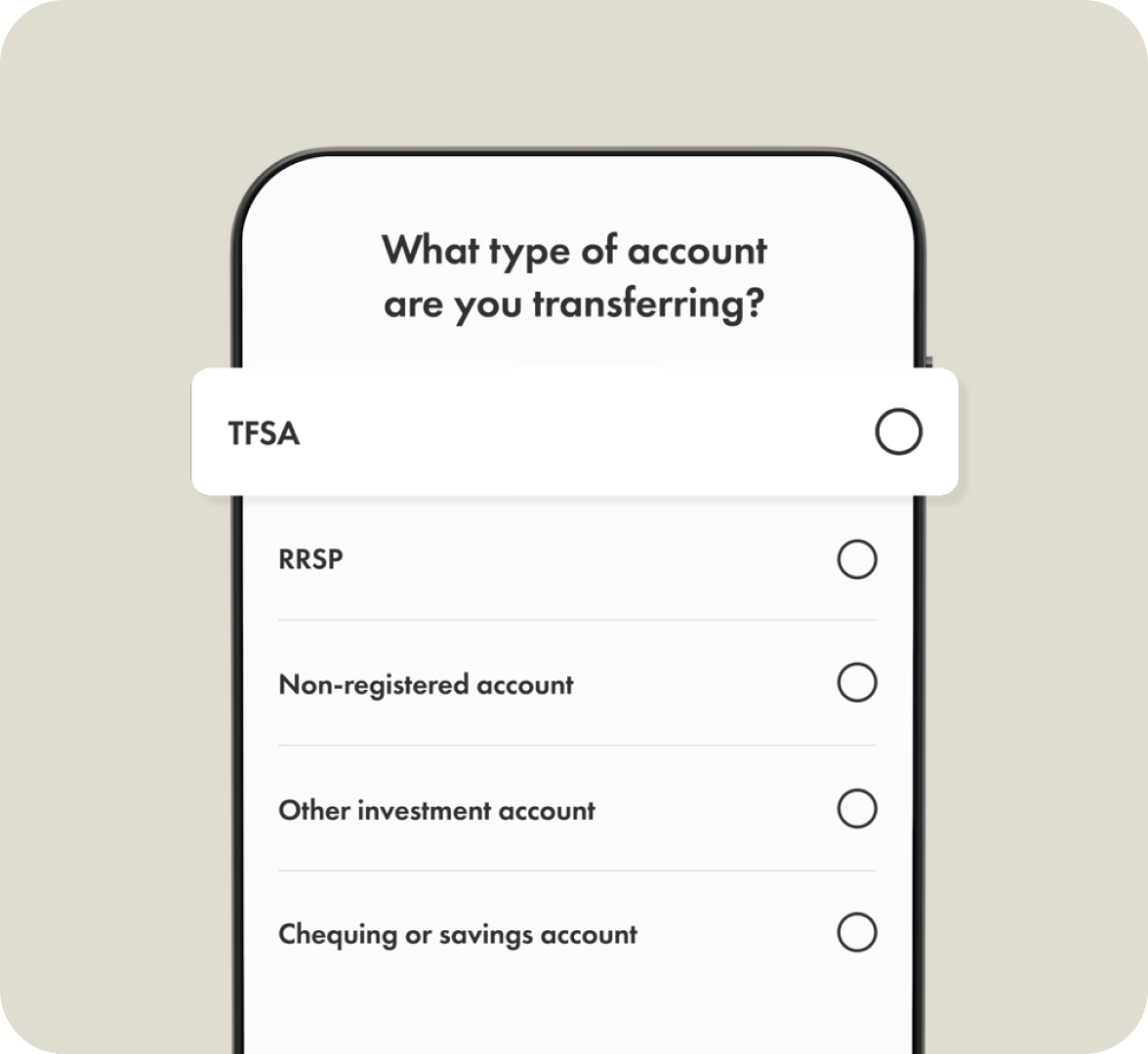

Switch your account without extra costs

Move your funds to Highgate Trading, and we’ll cover the transfer-out fees charged by your current brokerage when you transfer $15,000 or more. The process is seamless, and we’ll make sure you start saving right away.

Contact our teamGet the most from your investments

Navigate market ups and downs confidently with a diversified portfolio, customized to align with your personal values and financial objectives.

Get started